Monthly depreciation calculator

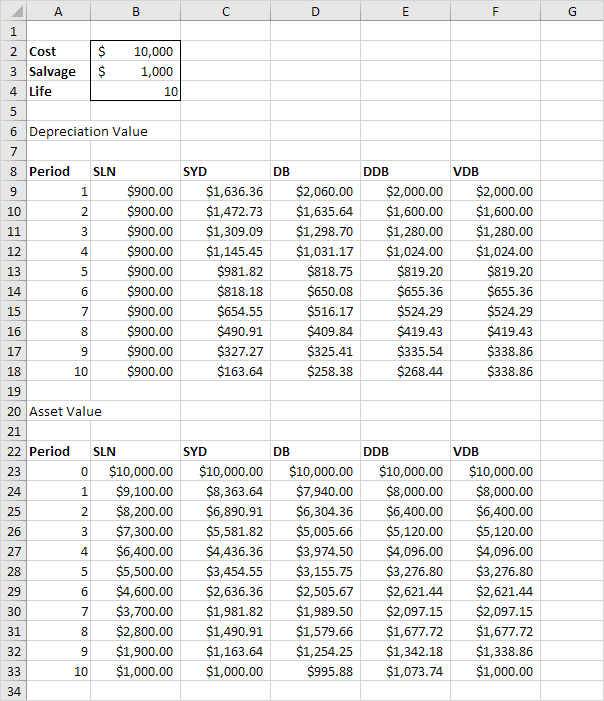

Cost salvage life period and month. We base our estimate on the first 3 year.

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

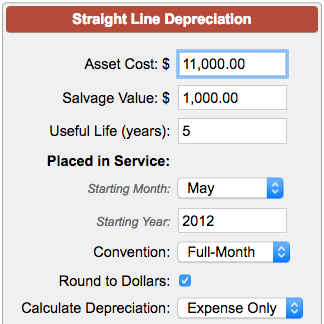

Line depreciation calculator exactly as you see it.

. Second year depreciation 2 x 15 x 900 360. The asset cost is 1500 and its usable life is 6 years. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. The calculator also estimates the first year and the total vehicle depreciation. Let us take the same example of how to calculate accumulated depreciation that we used in the straight-line method.

Divide 100 by the number of years in your assets useful life. Percentage Declining Balance Depreciation Calculator. For example if you have an asset.

We will even custom tailor the results based upon just a few of. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Ad Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence.

This car depreciation calculator is a handy tool that will help you estimate the value of your car once its been used. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. Ad Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence.

The first step to figuring out the depreciation rate is to add up all the digits in the number seven. The quotient you get is the SLD rate. You probably know that the value of a vehicle drops.

So in the second year your monthly depreciation falls to 30. Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule. Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States.

Multiply the value you get by 2. All you need to do is. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade.

According to a 2019 study the average new car depreciates by nearly half of its value after five years. Here are the steps for the double declining balance method. It is fairly simple to use.

Next youll divide each years digit by the sum. Select the currency from the drop-down list optional Enter the. Let us try another example as follows for a car.

The DB function is used for calculating fixed declining - balance depreciation and contains five arguments. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. 7 6 5 4 3 2 1 28.

Also includes a specialized real estate property calculator. You can calculate subsequent years in the same way with. The first four arguments are.

The calculator allows you to use. In other words the. However different cars depreciate at different rates with SUVs and trucks generally.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. For example if a cars cost basis is 1000 its residual value is 100 and its useful life is seven years depreciation expense equals 1000 - 100 7 or 900 7 which equals. Car Depreciation Calculator.

Calculator for depreciation at a declining balance factor of 2 200 of.

2

Declining Balance Depreciation Calculator

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Depreciation Rate Calculator Sale Online 57 Off Www Ingeniovirtual Com

Appreciation And Depreciation Calculator Https Salecalc Com Appdep Appreciation Calculator Calculators

How To Calculate Declining Balance In Excel Using Formula

Vehicle Depreciation Calculator Belgium Save 44 Countylinewild Com

Salvage Value Formula Calculator Excel Template

How Can I Make A Depreciation Schedule In Excel

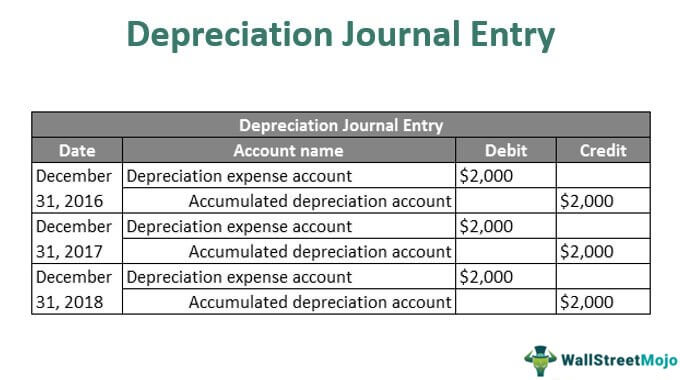

Depreciation Journal Entry Step By Step Examples

Depreciation Rate Calculator Online 60 Off Www Ingeniovirtual Com

Free Macrs Depreciation Calculator For Excel

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Salvage Value Formula Calculator Excel Template

How To Use The Excel Amorlinc Function Exceljet